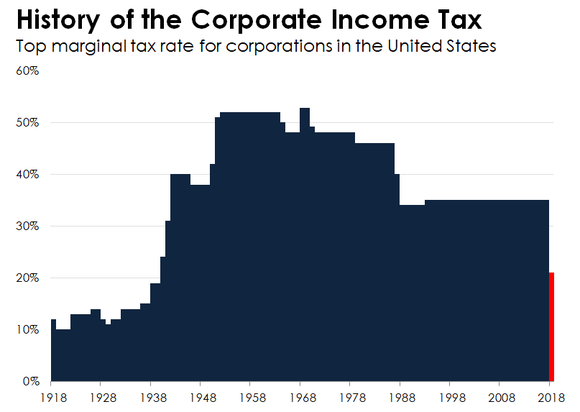

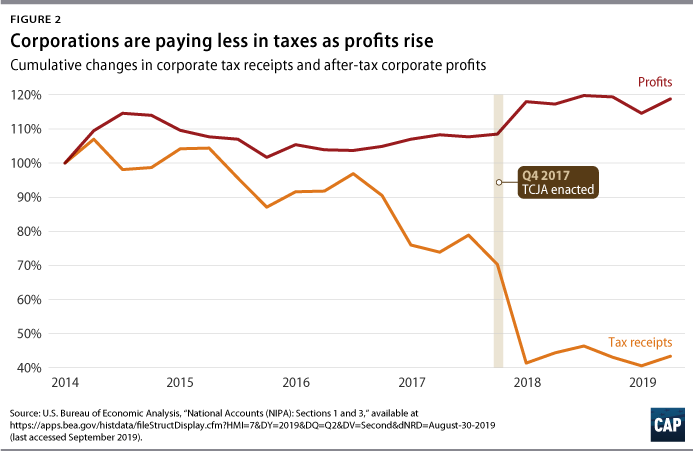

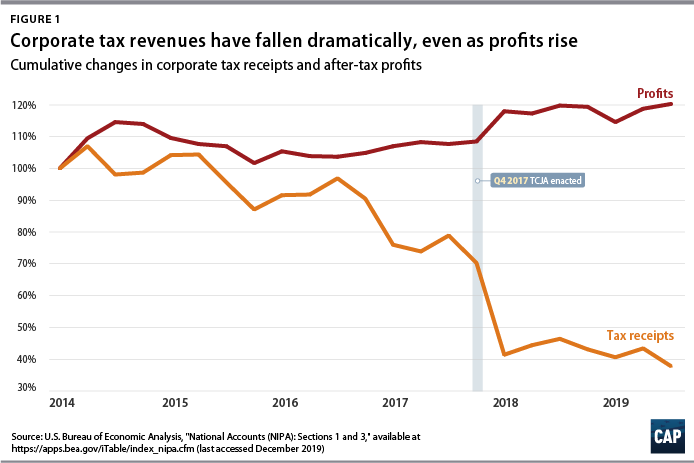

The TCJA 2 Years Later: Corporations, Not Workers, Are the Big Winners - Center for American Progress

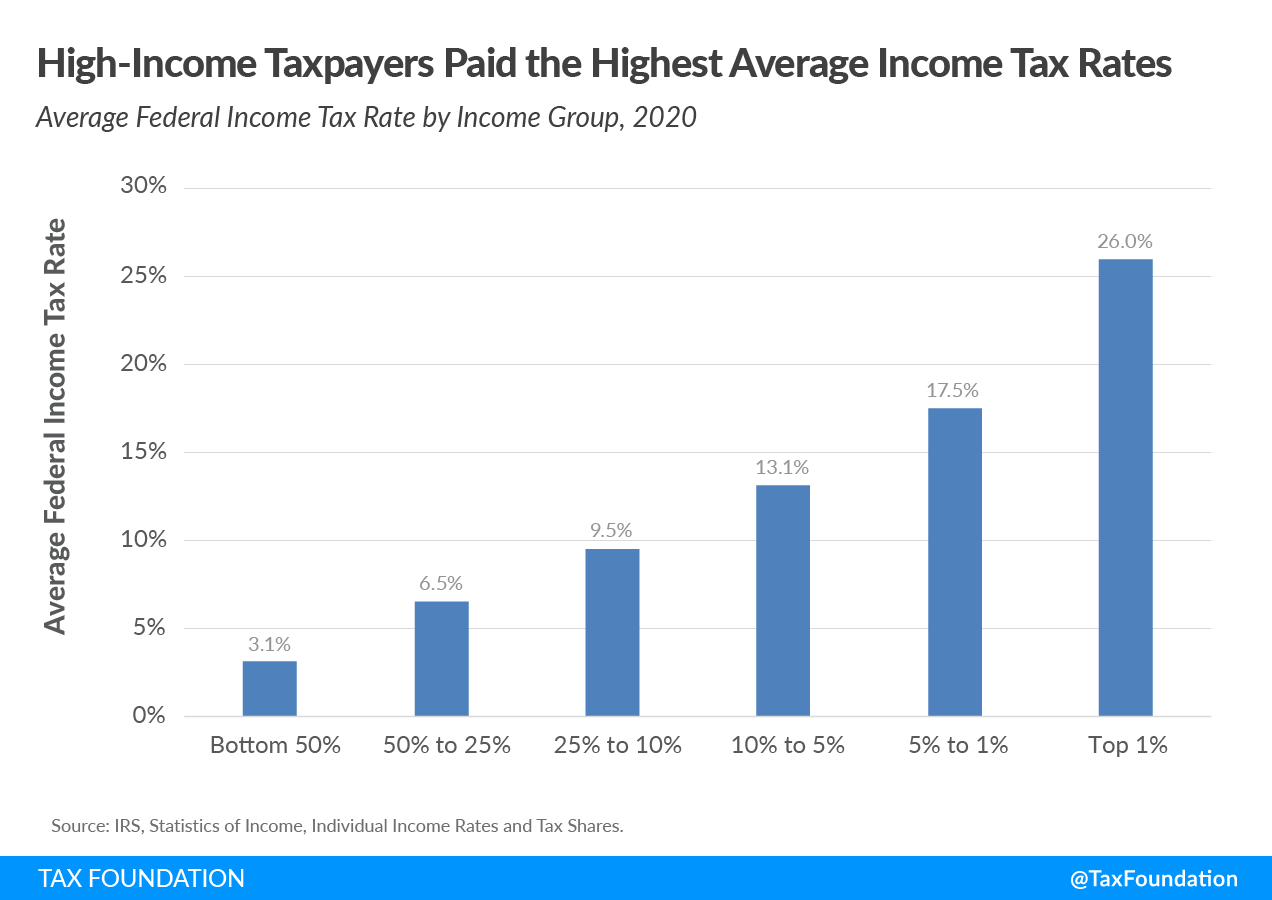

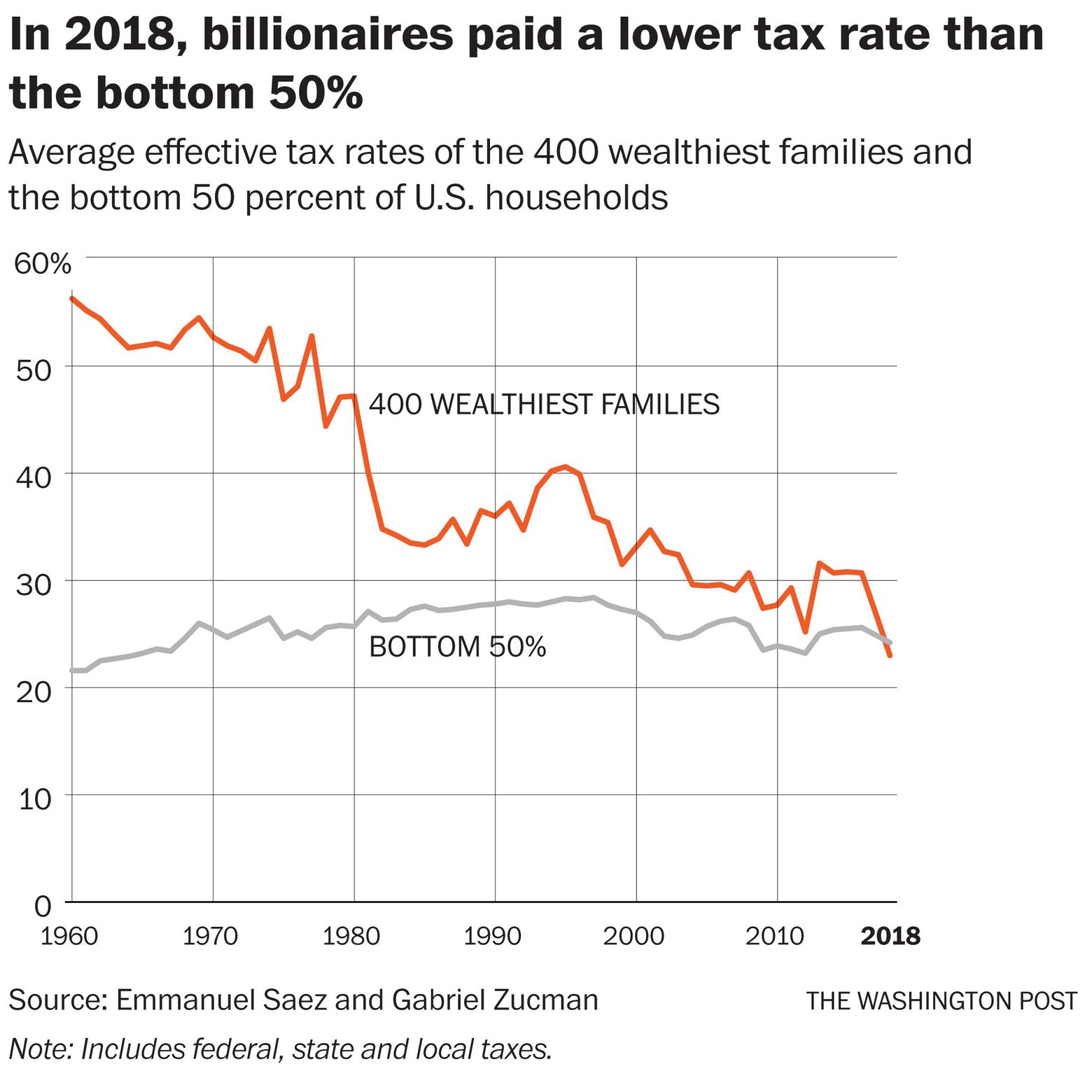

U.S. billionaires paid lower tax rate than working class last year, researchers say | The Seattle Times

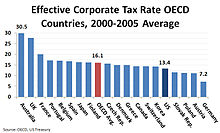

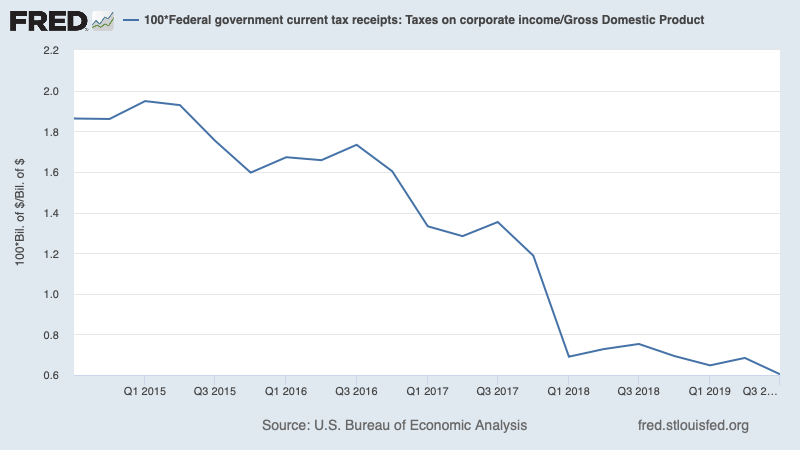

Finfacts Ireland: Corporate tax rate for biggest US firms below 11%- Silicon Six avoid $100bn+ in taxes